"Concentrate your strengths against your competitor's relative weaknesses."

By Bruce Henderson, The founder of the Boston Consulting Group (BCG)

This is The Finance and Investment Blog for stock markets in Thailand and US (NYSE, NASDAQ, AMEX and SET). Our ultimate goal is to Educate and Evaluate companies, stocks or derivatives using Value Investing Approach. We do believe in Investing not Trading or Speculation.

These 20-Points Fundamental Criteria will screen you value-oriented companies with Low Debt, High Expected Return at Reasonable price or Undervalued. The most score stocks expect to be superior investment opportunity in long run.

These 20-Points Fundamental Criteria will screen you value-oriented companies with Low Debt, High Expected Return at Reasonable price or Undervalued. The most score stocks expect to be superior investment opportunity in long run.

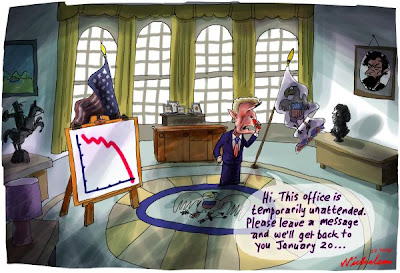

The psychology of speculation is a veritable theater of the absurd. Although the castle-in-the-air theory can well explain such speculative binges, outguessing the reactions of a fickle crowd is a most dangerous game. Unsustainable prices may persist for years, but eventually they reverse themselves.

The psychology of speculation is a veritable theater of the absurd. Although the castle-in-the-air theory can well explain such speculative binges, outguessing the reactions of a fickle crowd is a most dangerous game. Unsustainable prices may persist for years, but eventually they reverse themselves. Act I - The Tulip-Bulb Craze

Act I - The Tulip-Bulb Craze Act II - The South Sea Bubble

Act II - The South Sea Bubble Act III - Wall street lays an egg

Act III - Wall street lays an egg

The Housing Bubble Bursts – U.S. Bank like Countrywide and Washington Mutual continue to give housing loan to low-income household (sub-prime family) from 2000 – 2007 because housing market boom. Housing values fall as supply overwhelms demand. Many sub-prime borrowers find their house worth less than their mortgages, and they can’t afford to pay monthly payment as its interest adjustable. Defaults rate rise because borrowers don’t pay and foreclosure come in, which sends housing prices lower. The downward spiral begins.

The Housing Bubble Bursts – U.S. Bank like Countrywide and Washington Mutual continue to give housing loan to low-income household (sub-prime family) from 2000 – 2007 because housing market boom. Housing values fall as supply overwhelms demand. Many sub-prime borrowers find their house worth less than their mortgages, and they can’t afford to pay monthly payment as its interest adjustable. Defaults rate rise because borrowers don’t pay and foreclosure come in, which sends housing prices lower. The downward spiral begins.